Are you interested in taking advantage of the stock exchange to make some extra money? Exchange-traded funds (ETFs) can be an effective way to do that. With easy accessibility and low fees, ETFs represent a significant investment option for short-term players looking to capitalize on trends and long-term investors looking for steady returns over time.

If you’re new to trading and need help figuring out where to start, this article is here to help: we’ll walk you through everything you need to know about how to trade ETFs on the stock exchange. From selecting the suitable ETFs and understanding pricing dynamics through building your portfolio – let’s get started.

What are ETFs?

Exchange-traded funds, or ETFs, have been gaining popularity with investors recently. They are an easy way to diversify a portfolio with minimal effort and cost. ETFs are like mutual funds because both contain multiple stocks and bonds. The difference is that when you buy an ETF, its price is determined by supply and demand forces in the market throughout the day. Because of this, it can trade at a premium or less than its net asset value.

It provides more flexibility for investors who want to time the market or take advantage of short-term opportunities. ETFs also have lower costs than actively managed mutual funds, and they are tax efficient due to their structure which allows fewer capital gains distributions each year to shareholders. With these advantages, it’s no wonder why so many investors are choosing ETFs as part of their investing strategies. Saxo Dubai Markets is a great platform to start trading ETFs on the stock exchange.

What are the benefits of trading ETFs?

ETFs have several advantages when compared to other types of investments. Below are some of the key benefits that you should consider before trading ETFs on the stock exchange:

The main benefit of trading ETFs is their low cost and accessibility. With no entry or exit fees and minimal annual management costs, investing in ETFs can be much cheaper than other investments.

Another critical benefit is diversification. Most ETFs are designed to track the performance of stock markets or indices, allowing investors to spread their money across multiple sectors and industries. It reduces the risk of investing in individual stocks and can lead to better returns.

Finally, ETFs are highly liquid, which means they can be bought or sold quickly and easily. It makes them ideal for traders who want to capitalize on short-term market movements without waiting to execute large trades. Additionally, ETFs tend to generate fewer capital gains taxes and offer more flexible investment strategies.

How to select an ETF?

Before trading ETFs on the stock exchange, selecting the right ETF for your investing needs is crucial. Start by asking yourself questions such as: What type of asset am I looking to invest in? Am I looking for short-term or long-term returns?

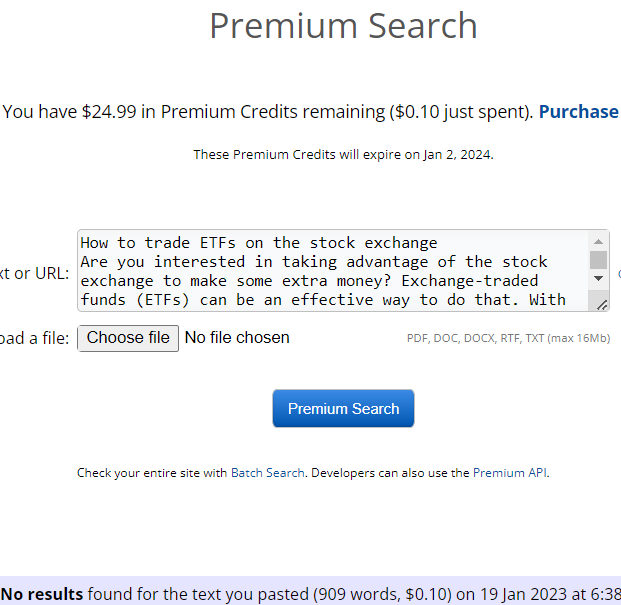

Once you’ve narrowed down your options and identified the type of ETFs you want to invest in, you can use tools such as the Saxo Dubai Markets screener to compare different ETFs and find the one that’s right for you. The screener allows you to filter by asset class, region, sector, or type of ETF. You can also search by performance metrics such as total return, volatility, and dividend yield.

When selecting an ETF, consider its expense ratio as well. The fee the fund charges for managing your investment can range from 0.25% to 1%. Higher fees reduce your overall return on investment, so try to find ETFs with lower expense ratios when possible.

What are the pricing dynamics of trading ETFs?

When you buy or sell an ETF, the price is determined by supply and demand forces in the market. It can trade at a premium or discount to its net asset value (NAV). This relationship between the NAV and the current price of an ETF is known as pricing efficiency.

An ETF with a higher degree of pricing efficiency will have a tighter spread between its current price and NAV, making it more attractive for traders who want to capitalize on short-term market movements or time the market. On the other hand, an ETF with lower pricing efficiency may be more suitable for long-term investors looking for a steady, reliable return.

Knowing how pricing dynamics work when trading ETFs on the stock exchange is essential.

How to build a portfolio with ETFs

Once you’ve selected the right ETFs for your investing goals, it’s time to build a portfolio. When constructing a portfolio with ETFs, diversification is critical. A well-diversified portfolio should typically consist of between 10 and 20 different ETFs.

The most basic way to begin building a portfolio with ETFs is to allocate a specific percentage of funds to each ETF based on the amount you have available and your risk tolerance. For example, if you have $10,000 to invest, you may allocate 30% to US stocks, 20% to international stocks, 30% to bonds and 10% to commodities.

Alternatively, you can use a strategic or tactical approach to building a portfolio with ETFs. With a strategic approach, you focus on long-term goals and allocate funds based on what type of return you’re looking for over time. A tactical approach involves actively monitoring the market and rebalancing your portfolio based on changes in market conditions.